Investing activities section of statement of cash flows

The rest of this article explains investing activities include how inflows and outflows of cash caused by such activities are computed and reported in the statement of cash flows. Cash flow from investing activities is a line item on a business’s cash flow statement, which is one of the major financial statements that companies prepare. Cash flow from investing activities is the net change in a company’s investment gains or losses during the reporting period, as well as the change resulting from any purchase or sale of fixed assets. Investing activities are one of the main categories of net cash activities that businesses report on the cash flow statement.

- Every investment decision should align with the intended risk tolerance, financial objectives, and time horizon.

- Once you have defined your goals and risk tolerance, it’s time to explore various investment vehicles.

- This helps in getting the whole picture and also helps to take a much more calculated investment decision.

- Negative net cash flows from investing activities are financed out of positive cash flows from operating activities and/or cash flows from financing activities.

- As discussed, this section includes cash used for the purchase of long-term assets and cash received from the sale of assets and investments.

Lists of Investing Activities in Accounting

Acquisitions involve a company purchasing another company to expand its market presence or acquire new technologies. Mergers can also fall under this category, impacting a company’s long-term growth strategy. Regularly reviewing your investment performance and making necessary adjustments based on market conditions, financial goals, and personal circumstances is key to long-term success.

- Making investment choices based on emotions—such as fear or greed—can lead to rash decisions.

- The company allocated 771,109 thousand dollars towards capital expenditures, reflecting its commitment to expanding infrastructure and enhancing technological capabilities.

- On the other hand, cash inflows from selling assets or investments can enhance a company’s liquidity position.

- Investments in long-term assets can lead to increased revenue streams and higher profitability over time.

- Economic downturns can lead to cash flow constraints, forcing companies to reassess their investment strategies.

Investing Activities and Reporting it on Cash Flow Statement

The core principle of investing activities is to harness available resources gym bookkeeping to create more wealth over time. Moreover, the outcomes of these investments contribute significantly to a company’s competitive position in the market and its overall sustainability. A well-defined strategic plan that incorporates prudent investing activities helps businesses respond to market changes and capitalize on opportunities, thereby securing their long-term viability. Another example is the sale of investments or assets that the company no longer needs, which can generate cash inflow. This can include selling old inventory, divesting from non-strategic holdings, or liquidating investments that no longer align with the company’s goals. The importance of investing activities lies in their potential to generate revenue and support growth strategies.

What are investing activities in finance?

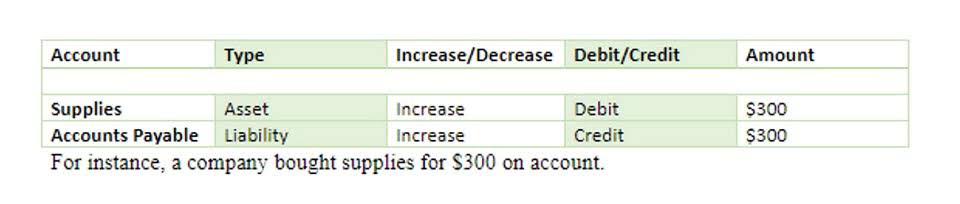

Cash flow from operating activities takes place when the activities performed by your business brings in net income. For example, cash sources from sales, cash used to purchase inventory, payment of operating expenses like salaries and utilities. In fact, cash flows from operating activities also include cash flows from income tax, interest, and dividend revenue interest expense. Investing activities in a cash flow statement refer to the section that records cash flow from purchases and sales of long-term assets and investments that https://velopyrenees.fr/bookkeeping/fcf-free-cash-flow-what-it-means-and-how-to-use-it/ are not considered cash equivalents. Investments are a little more complicated than the long-term assets because it depends on the source of the investment.

Purchase and sale of intangible assets

For example, cash paid for short-term investments like trading securities and cash equivalents are included in this section. However, payments on a note payable from a customer that resulted in a sale are typically listed in the operating activities section—not the investing. Likewise, FASB requires that all interest payments and receipts be classified as operating activities.